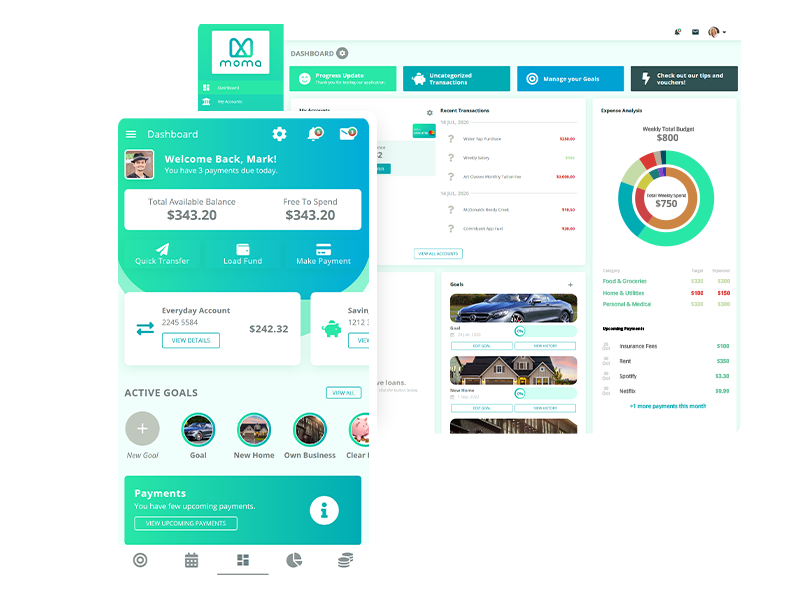

MoMa provides you with an easy to use tool to assist in achieving your financial objectives, whatever they may be. We are more than just a budgeting app, we are a complete Money Managing platform that assist everyday Australians achieve financial freedom.

In a Pinch? MoMa makes Money Management a Cinch!

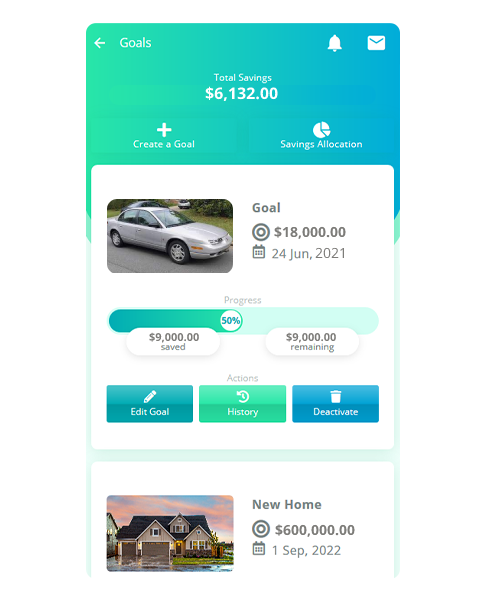

MoMa integrates with nearly every Australian transaction bank account, to allow a personalised user interface which puts you in the driver's seat. Set your own goals, rid yourself of debt and see your progress along the way.

Take control of your finances! MoMa is more than just numbers on a screen…

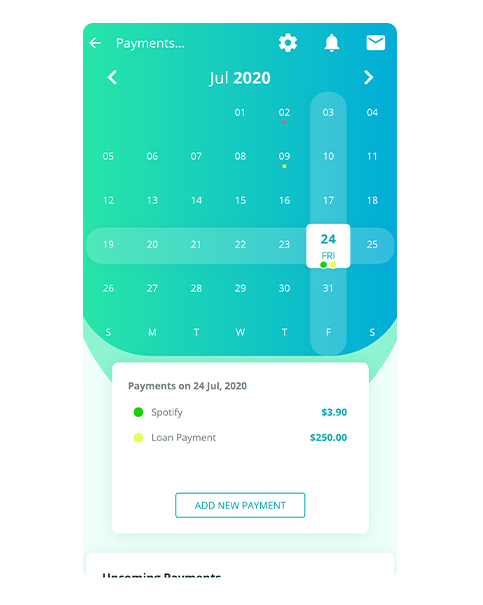

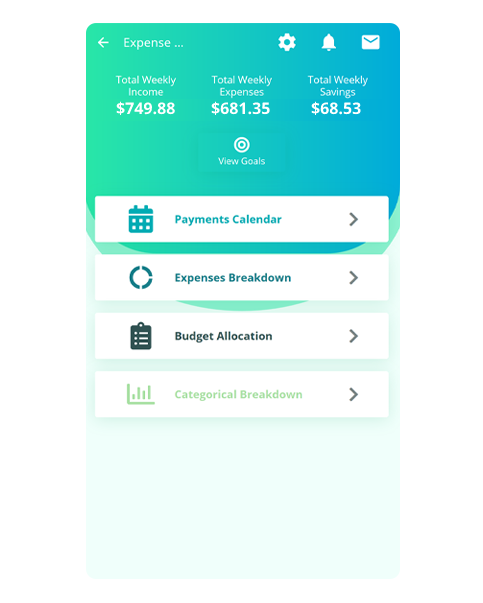

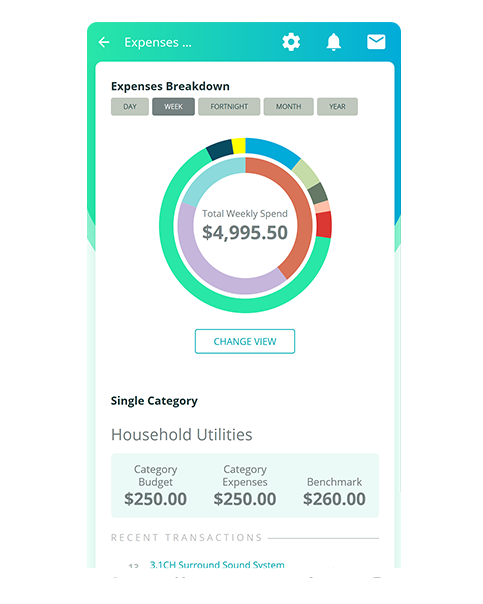

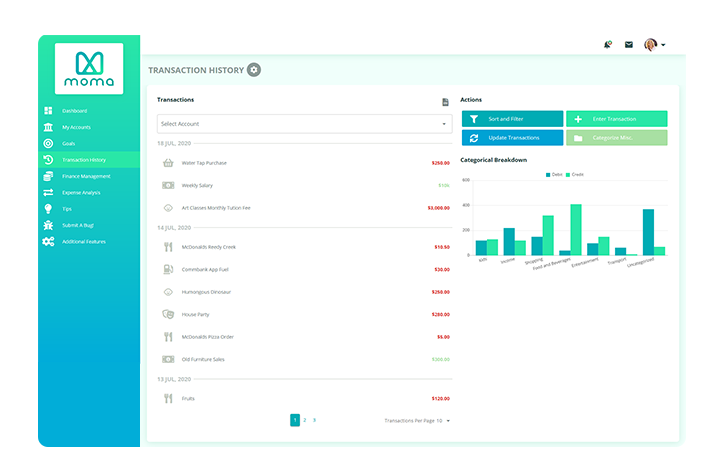

Track spending. Budget simply. Save to meet your goals. The MoMa app is free to download and easy-to-use! Financial insight, expense analysis – MoMa shows you where your money is going and allows you to manage your spend better. With notifications and reminders, you’ll never forget an upcoming bill again!

Managing money made easy!

MoMa provides you with an easy to use tool to assist in achieving your financial objectives, whatever they may be. We are more than just a budgeting app, we are a complete Money Managing platform that assist everyday Australians achieve financial freedom.

How does it Work?

Download MoMa

MoMa is available on the App Store & Google Play.

Sign Up

MoMa populates your financial information without hassle.

Save Money

MoMa gets to work so you can focus on the day-to-day.

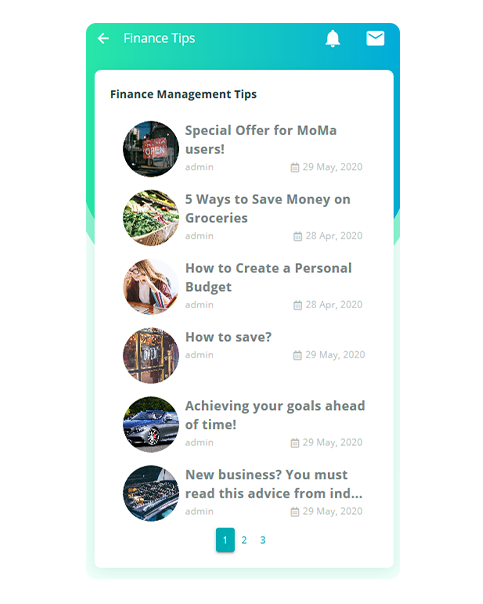

From the blog

Play Slots On the internet and Earn Real money Finest A real income Position Video game

Posts Lets Evaluate The top 5 Real cash Harbors Web sites What’s the Difference between Video poker And you may Slot machines? Our company is today moving on the a full world of heightened and you will immersive technologies with the potential to revolutionize the fresh gambling sense. Space and you will Galaxy – Gamers … Continued

Read moreSpin Local casino No-deposit Bonus Rules, Totally free Revolves

Content What is actually A no cost Twist Extra? The best No deposit Harbors Discovered Current email address Presents The newest Hyperlinks By Subscribing Another preferred table game are enjoyable variations from Roulette, video poker and you will Baccarat. 9 Goggles from 88 Wild Dragon slot machine Flames originates from the fresh creative thoughts out … Continued

Read moreGreatest Online slots Casinos To experience For real Cash in 2024

Blogs #ten Very Harbors Mr Macau: Better Online casino For three dimensional Ports House Casinos Inside Mississippi As a whole, you can find from the 230 slot Wonder Woman additional slot online game happy to getting played. This includes dated-school classics along with fresh and you can innovative projects. It is a 5-pay range slot … Continued

Read more